Discover Bank online savings account bonus offers present a compelling opportunity for savvy savers. This comprehensive guide delves into the specifics of these bonuses, exploring the features of Discover Bank’s online savings account, comparing it to competitors, and outlining the account opening process. We’ll also examine the terms and conditions of the bonus offers, providing you with the knowledge to make an informed decision about whether this account aligns with your financial goals.

We’ll cover everything from minimum deposit requirements and interest rates to security measures and customer service options. By the end of this guide, you’ll have a clear understanding of the benefits and drawbacks of Discover Bank’s online savings account and its associated bonus promotions, empowering you to choose the best savings solution for your needs.

Discover Bank Online Savings Account Overview

Discover Bank offers a competitive online savings account designed for convenience and ease of access. This overview details its features, benefits, drawbacks, and a comparison to other leading online savings accounts.

Detailed Feature Description

Discover Bank’s online savings account provides a straightforward and user-friendly banking experience. The following table summarizes its key features:

| Feature | Description |

|---|---|

| Minimum Deposit | Typically $0, though promotional offers may require a higher initial deposit. Check Discover’s website for the most current information. |

| Monthly Fee | None |

| Transaction Limits | Six withdrawals per statement cycle are permitted. Transfers to other Discover accounts are generally unlimited. Specific limitations may apply depending on account type and promotional offers. Always refer to your account agreement. |

| ATM Access | No direct ATM access is provided with the online savings account. |

| Mobile App | The Discover mobile app allows for account monitoring, transfers, and customer service access. Features include mobile check deposit, budgeting tools, and account alerts. |

| Online Banking | The online banking portal offers account management, bill pay integration, and customizable account alerts. |

| Debit Card | Not directly associated with the online savings account. A separate checking account is needed to obtain a Discover debit card. |

Key Benefits and Drawbacks

Understanding the advantages and disadvantages of a Discover online savings account is crucial for informed decision-making.

Benefits:

- High Interest Rate (Potentially): Discover frequently offers competitive annual percentage yields (APYs) compared to many traditional banks.

- No Monthly Fees: Avoids recurring charges common with some savings accounts.

- Convenient Online and Mobile Access: Manage your account anytime, anywhere.

- Strong Online Security: Discover employs robust security measures to protect customer data and funds.

- User-Friendly Interface: Both the website and mobile app are generally considered easy to navigate.

Drawbacks:

- Limited ATM Access: Lack of ATM access may be inconvenient for some users.

- Transaction Limits: The six-withdrawal limit per statement cycle could be restrictive for frequent access needs.

- Variable Interest Rates: APYs can fluctuate, impacting the return on your savings.

- No Debit Card Directly Linked: Requires a separate checking account for debit card access.

- Customer Service Availability: While multiple channels are offered, wait times may vary.

Interest Rate and Calculation Methods

The APY for Discover’s online savings account is variable and subject to change. Discover’s website should be consulted for the most current rate. Interest is typically calculated daily on the collected balance and credited monthly. The compounding method is daily.

Hypothetical Example:

Let’s assume a 3% annual percentage yield (APY) and a $10,000 deposit. With daily compounding, the interest earned over one year would be approximately $304.16 (This is a simplified example and the actual amount may vary based on the precise APY and daily balance). The interest is paid monthly.

Account Accessibility and Security

Discover Bank uses multiple layers of security, including encryption and fraud monitoring systems, to protect account information and funds. Accounts are accessible via the Discover website and mobile app. Access may be restricted through security measures like multi-factor authentication.

Customer Service

Discover offers customer service via phone, email, and online chat. Operating hours vary; details can be found on their website. Customer service ratings can be found on sites like the Better Business Bureau, though these ratings fluctuate.

Comparison to Competitors

Discover’s online savings account compares favorably to other online banks, but its competitiveness depends on the current APY offered. The following table offers a brief comparison (note: APYs and fees are subject to change and should be verified on each bank’s website):

| Feature | Discover Bank | Capital One 360 | Ally Bank |

|---|---|---|---|

| APY | Variable (Check website) | Variable (Check website) | Variable (Check website) |

| Monthly Fee | None | None | None |

| Minimum Deposit | $0 (Typically) | $0 | $0 |

| Key Feature | Competitive APY (often) | Wide range of financial products | Excellent customer service reputation |

*Disclaimer: This information is for general knowledge and informational purposes only, and does not constitute financial advice. The information provided may not be completely accurate or up-to-date. Always consult Discover Bank’s official website for the most current terms and conditions.*

Bonus Offers and Promotions Analysis

Discover Bank frequently offers promotional bonuses on its online savings accounts to attract new customers and reward existing ones. Analyzing these offers and comparing them to competitors helps consumers make informed decisions about where to park their savings. The specifics of these bonuses change periodically, so it’s crucial to check the Discover Bank website for the most up-to-date information.

Understanding the terms and conditions is vital to maximizing the benefits of any bonus offer. Factors such as the minimum deposit required, the duration of the promotional period, and any restrictions on withdrawals should be carefully considered before opening an account.

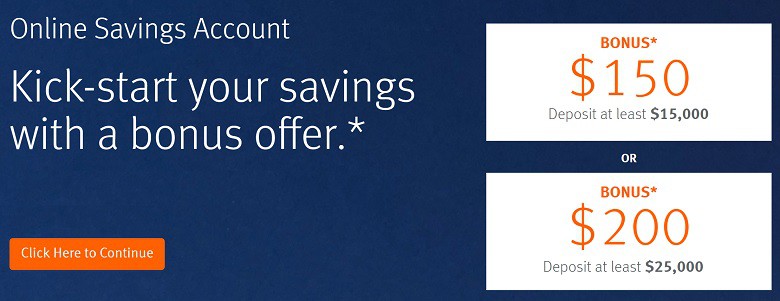

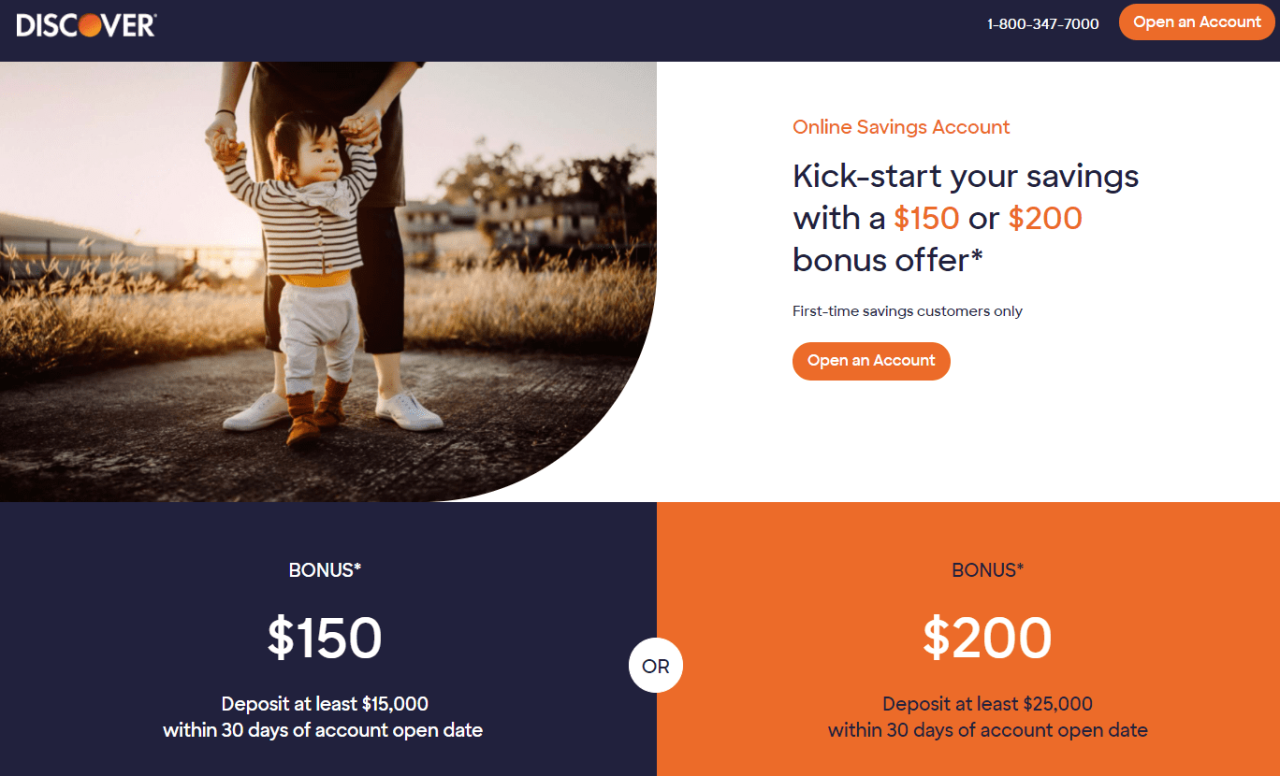

Current Discover Bank Online Savings Account Bonus Offers

Discover Bank’s online savings account bonus offers vary. At the time of writing, a typical offer might involve a certain interest rate increase for a specified period, or a cash bonus after meeting a minimum deposit and maintaining the balance for a certain length of time. For example, a recent promotion may have offered a 2% annual percentage yield (APY) for the first six months on new deposits, followed by a reversion to the standard APY. Another potential offer could be a $100 cash bonus for opening an account and depositing $10,000 within 30 days, with the condition that the funds remain in the account for a minimum of six months. It is important to note that these are examples and current promotions may differ. Always refer to the official Discover Bank website for the most accurate and current information.

Comparison with Competing Banks

Competitor banks often offer similar promotions, but the specifics vary. Some may offer higher initial APYs but for shorter periods, while others might provide larger cash bonuses but require significantly higher minimum deposits. For instance, a competitor might offer a 3% APY for the first three months, but with a $25,000 minimum deposit, while another might offer a $200 bonus for a $15,000 deposit, but with a 12-month maintenance requirement. A thorough comparison of all relevant factors, including APY, bonus amounts, minimum deposit requirements, and maintenance periods, is essential before making a decision.

Terms and Conditions of Discover Bank Bonus Offers, Discover bank online savings account bonus

Each Discover Bank online savings account bonus offer has specific terms and conditions that determine eligibility. These typically include minimum deposit requirements, minimum balance maintenance periods, and restrictions on withdrawals during the promotional period. Failure to meet these conditions may result in forfeiture of the bonus. For example, if a promotion requires a $10,000 minimum deposit for six months, withdrawing any portion of that amount before the six-month period expires could disqualify the account holder from receiving the bonus. Furthermore, eligibility may be restricted to new customers only or those opening a new account. The terms and conditions are usually clearly Artikeld on the promotional materials and the Discover Bank website. It’s recommended to carefully review these details before accepting any offer.

Account Opening Process

Opening a Discover Bank online savings account is a straightforward process designed for ease and convenience. This section details the steps involved, potential issues, and helpful information for new customers. We’ll also compare Discover Bank’s offerings to those of its competitors.

Detailed Steps for Online Discover Bank Savings Account Opening

The following steps Artikel the process of opening a Discover Bank online savings account. While screenshots are unavailable here, a detailed description of each step and relevant webpage elements will be provided. Remember to always double-check information before submitting.

- Navigate to the Discover Bank website and locate the “Open an Account” button. This button is typically prominently displayed on the homepage. Clicking this button will take you to the account application page.

- Select “Savings Account” as your desired account type. You’ll be presented with various account options; carefully select the online savings account. The page will likely feature a brief description of the account’s features and benefits.

- Complete the application form. This form will request personal information, including your full name, address, date of birth, Social Security number, and contact information. Ensure all information is accurate and matches your official documents. Incorrect information will delay or prevent account opening.

- Create a secure password. Choose a strong password that meets Discover Bank’s complexity requirements (length, character types, etc.). Remember your password, as you’ll need it for future logins.

- Review and submit the application. Before submitting, carefully review all entered information to ensure accuracy. Once you’re confident, click the “Submit” button to finalize the application.

- Fund your account. After application approval, you will be prompted to make an initial deposit. Discover Bank likely offers various funding options, such as linking an existing bank account or using a debit card.

Step-by-Step Guide with Error Handling

Opening a Discover Bank online savings account requires careful attention to detail. The following numbered list details each step, highlighting potential errors and their solutions:

- Navigate to the Discover Bank website and locate the “Open an Account” button. Error: Website not found. Solution: Verify the URL or use a search engine to find the official Discover Bank website.

- Select “Savings Account.” Error: Unable to locate the savings account option. Solution: Check if the website is experiencing technical difficulties or contact Discover Bank customer support.

- Complete the application form. Error: Incorrect address or Social Security number. Solution: Double-check the information against your official documents and correct any errors before submitting.

- Create a secure password. Error: Password doesn’t meet complexity requirements. Solution: Ensure the password meets the length and character type criteria specified by Discover Bank (e.g., minimum length, uppercase and lowercase letters, numbers, and symbols).

- Review and submit the application. Error: Application rejected. Solution: Contact Discover Bank customer support to inquire about the reason for rejection and to resolve any issues.

- Fund your account. Error: Insufficient funds or invalid account information. Solution: Verify the linked account details and ensure sufficient funds are available for the initial deposit.

Flowchart of the Account Opening Process

(A visual flowchart would be included here. It would show the steps in a branching diagram, illustrating decision points such as successful password creation, successful address verification, and successful initial deposit. The flowchart would depict successful completion leading to account activation, and unsuccessful attempts leading to error messages and opportunities to correct information.)

New Customer Onboarding Guide

This guide answers frequently asked questions for new Discover Bank online savings account customers.

Frequently Asked Questions (FAQs)

- Q: How do I access my account? A: You can access your account online through the Discover Bank website or mobile app using your username and password.

- Q: What security measures are in place? A: Discover Bank utilizes various security measures, including encryption, multi-factor authentication, and fraud monitoring, to protect your account and personal information.

- Q: What are the methods for making an initial deposit? A: You can typically fund your account via electronic transfer from another bank account or using a debit card.

- Q: What if I forget my password? A: You can reset your password through the Discover Bank website or mobile app by following the password recovery instructions.

- Q: How do I contact customer support? A: You can contact Discover Bank customer support via phone, email, or through their online help center.

Comparison of Online Savings Accounts

The following table compares Discover Bank’s online savings account with those of Ally Bank and Capital One 360. (Note: Interest rates and fees are subject to change and should be verified on the respective bank websites.)

| Feature | Discover Bank | Ally Bank | Capital One 360 |

|---|---|---|---|

| Interest Rate (APY) | [Insert current rate] | [Insert current rate] | [Insert current rate] |

| Minimum Balance Requirement | [Insert requirement] | [Insert requirement] | [Insert requirement] |

| Fees | [List any fees] | [List any fees] | [List any fees] |

| Customer Support | [Describe options] | [Describe options] | [Describe options] |

Welcome Email to New Customer

Subject: Welcome to Discover Bank!

Dear [Customer Name],

Welcome to the Discover Bank family! We’re thrilled to have you as a new online savings account customer.

To help you get started, please visit [link to helpful resources page]. For any questions or assistance, please don’t hesitate to contact our customer support team at [phone number].

Sincerely,

The Discover Bank Team

Documentation Requirements

The following documents may be required to open a Discover Bank online savings account. Specific requirements may vary.

- Government-issued photo ID: Acceptable formats: PDF, JPG. Size/resolution restrictions: [Specify restrictions if any]

- Proof of address: Acceptable formats: PDF, JPG. Size/resolution restrictions: [Specify restrictions if any]

- Social Security number (SSN): Required for verification purposes.

Required Information from Documents

| Document | Required Information | Optional Information |

|---|---|---|

| Government-issued Photo ID | Full Name, Date of Birth, Address, Photo | N/A |

| Proof of Address | Full Name, Current Address | N/A |

Discover Bank’s Security Measures

Discover Bank employs robust security measures to protect customer data during the account opening process and beyond. These measures include data encryption, multi-factor authentication, fraud detection systems, and adherence to strict data privacy regulations. We are committed to safeguarding your information and ensuring a secure banking experience.

Account Management Features

Managing your Discover Bank online savings account is designed to be straightforward and secure, offering a range of convenient features accessible through both online and mobile platforms. This section details the various tools and methods available for managing your account effectively and safely.

Online Banking Features

Accessing your Discover Bank online savings account is a simple process. To log in, navigate to the Discover Bank website and locate the “Sign In” button, usually prominently displayed. You will then be prompted to enter your username and password. For enhanced security, Discover Bank strongly encourages the use of two-factor authentication (2FA). This involves adding an extra layer of security, typically via a one-time code sent to your registered mobile phone or email address, after entering your password. If you forget your password, click the “Forgot Password” link; you’ll receive instructions on how to reset it via email. The entire process emphasizes a balance between user-friendliness and robust security protocols.

Account balances, transaction history, and pending transactions are all readily available within the online banking dashboard. Your account balance is displayed prominently upon login. Transaction history displays all activity within the account, usually for the past 12 months, with the ability to download statements in PDF and CSV formats for record-keeping. Pending transactions are clearly marked, showing expected posting dates.

Discover Bank allows for the customization of alerts, providing notifications for various account events. Users can set up alerts for low balances (below a specified threshold), large transactions (exceeding a defined amount), and other customizable triggers. Notifications can be sent via email, SMS text message, or push notifications (if using the mobile app).

Accessing and managing online statements is straightforward. The account dashboard provides a clear link to your statement archive. Statements are available in PDF format for easy viewing, downloading, and printing. Archived statements are typically retained for several years, enabling convenient access to historical records.

Mobile Banking Features

Discover Bank offers a dedicated mobile banking app for both iOS and Android operating systems. Download links can be found on the Discover Bank website or by searching for “Discover Bank” in the Apple App Store or Google Play Store.

The mobile app boasts a user-friendly interface with intuitive navigation. The main dashboard provides a quick overview of account balances and recent transactions. Key navigation elements, such as menus and icons, are clearly labeled and easy to understand. The overall user experience is designed to be smooth and efficient. (Note: Screenshots are not included in this text-based response.)

Mobile-specific features include mobile check deposit, allowing you to deposit checks by taking a picture of them through the app (subject to deposit limits). A built-in ATM locator uses your device’s GPS to find nearby Discover Bank ATMs. Mobile bill pay allows you to schedule payments directly from the app. The mobile check deposit feature may have a daily or per-check limit, which is clearly stated within the app.

The Discover Bank mobile app employs several security measures to protect your account information. These include biometric authentication (fingerprint and facial recognition, where device capabilities allow), secure login procedures, and automatic session timeouts after a period of inactivity.

Fund Transfer Methods

Transferring funds into and out of your Discover Bank online savings account is facilitated through various methods. The following tables detail the available options, fees, and processing times. Note that fees and processing times are subject to change and may vary based on specific circumstances. Always check the most up-to-date information on the Discover Bank website.

Transferring Funds *Into* Your Account

| Transfer Method | Fee | Processing Time | Requirements |

|—|—|—|—|

| Wire Transfer | Varies (check with bank) | 1-3 business days | Wire transfer instructions from sending institution |

| ACH Transfer | Typically none | 1-3 business days | Account and routing numbers from sending institution |

| Mobile Check Deposit | Typically none | 1-2 business days | Clear image of check, within app limits |

| PayPal | Typically none | 1-3 business days (dependent on PayPal) | Linked PayPal account |

| Venmo | Typically none | 1-3 business days (dependent on Venmo) | Linked Venmo account |

Transferring Funds *Out* of Your Account

| Transfer Method | Fee | Processing Time | Requirements |

|—|—|—|—|

| Online Transfer (Internal) | Typically none | Instant (often) | Destination account within Discover Bank |

| Online Transfer (External) | Typically none | 1-3 business days | Account and routing numbers of recipient bank |

| Wire Transfer | Varies (check with bank) | 1-3 business days | Recipient’s bank details |

| Check | Typically none | 5-7 business days | Mailing address of recipient |

| Bill Pay | Typically none | Varies (dependent on biller) | Biller’s information |

Account Security Measures

Discover Bank employs multiple layers of security to safeguard your account information. These include robust encryption protocols to protect data transmitted between your device and the bank’s servers, sophisticated fraud detection systems that continuously monitor transactions for suspicious activity, and 24/7 security monitoring to identify and address potential threats.

To report suspicious activity or potential fraud, contact Discover Bank immediately via phone at [Insert Discover Bank Phone Number Here], email at [Insert Discover Bank Email Address Here], or through their website at [Insert Discover Bank Website Link Here].

In the event of a security breach, Discover Bank will follow established protocols to contain the breach, investigate the cause, and notify affected customers as required by law. The bank is committed to protecting customer data and will take all necessary steps to mitigate any potential harm.

Important Security Note: Never share your account number, password, or other sensitive information via email or unsecured websites. Always access your account through official channels.

Customer Support and Service: Discover Bank Online Savings Account Bonus

Discover Bank prioritizes providing comprehensive and accessible customer support to its online savings account holders. They understand that efficient and helpful service is crucial for maintaining customer satisfaction and trust. Multiple channels are available to assist customers with inquiries, account management, and troubleshooting.

Discover Bank offers several avenues for customers seeking assistance. These options provide flexibility and cater to individual preferences. Understanding the available support channels and the typical issues addressed through each can help customers quickly resolve any concerns.

Available Customer Support Channels

Customers can contact Discover Bank’s customer support team through several channels. Phone support provides immediate assistance for urgent issues, while email allows for detailed inquiries and documented responses. The bank’s website also features a comprehensive FAQ section that addresses many common questions. Additionally, Discover may offer support through live chat functionality on their website, though this is subject to change. The specific availability of each channel may vary depending on the time of day and day of the week.

Common Customer Service Issues and Resolutions

Several common issues arise for online savings account holders. These range from questions about interest rates and account statements to troubleshooting login problems or addressing potential security concerns. For instance, a customer might inquire about the process for transferring funds or request assistance with a forgotten password. In such cases, customer service representatives can guide users through the necessary steps, potentially resetting passwords or explaining the transfer procedures in detail. Similarly, questions regarding account fees or the calculation of interest earned are frequently addressed through these channels. Discrepancies in account balances can also be investigated and resolved with the help of customer support.

Customer Reviews and Feedback on Customer Service

Customer reviews and feedback regarding Discover Bank’s customer service vary. While many customers report positive experiences with helpful and responsive representatives, some express frustration with long wait times or difficulties reaching a live agent. Online forums and review sites often reflect this range of experiences. It’s important to note that individual experiences can differ based on factors such as the time of day, the specific representative contacted, and the complexity of the issue. For example, while some users praise the efficiency of email support for non-urgent matters, others might prefer the immediacy of a phone call for time-sensitive issues. Overall, assessing the customer service experience requires considering the diversity of opinions and individual circumstances.

Ultimately, the decision of whether to open a Discover Bank online savings account and take advantage of any bonus offers depends on your individual financial circumstances and priorities. Carefully weigh the benefits, such as competitive interest rates and potential bonuses, against any associated fees or limitations. By thoroughly understanding the terms and conditions, comparing it to alternatives, and considering your personal needs, you can make an informed choice that aligns with your long-term financial goals. Remember to always consult Discover Bank’s official website for the most current information.

Answers to Common Questions

What happens if I miss the deadline for a bonus offer?

Generally, you will not receive the bonus if you fail to meet the eligibility requirements or deadlines specified in the terms and conditions. Contact Discover Bank customer service for clarification on specific cases.

Can I transfer my bonus to another account?

This depends on the specific terms and conditions of the bonus offer. Some bonuses may be credited directly to the savings account, while others may have restrictions on transfers. Check the fine print for details.

What if I close my account before the bonus period ends?

Closing your account prematurely may result in forfeiture of the bonus. The terms and conditions of the bonus offer will specify any penalties for early account closure.

Are there any tax implications for receiving a savings account bonus?

Yes, any interest earned, including bonus interest, is generally taxable income. Consult a tax professional for personalized advice.