Cit Bank add joint owner: Managing finances as a couple often involves opening a joint account. This guide provides a comprehensive overview of adding a joint owner to your Cit Bank account, covering the process, eligibility requirements, responsibilities, security measures, and legal considerations. We’ll explore different account types, online versus in-person procedures, and address common questions to ensure a smooth and informed experience.

Understanding the nuances of joint ownership is crucial for financial harmony and legal clarity. This guide aims to clarify the steps involved, from initial application to managing the account after the addition of a joint owner. We will also delve into the security features Cit Bank offers to protect joint accounts and discuss the responsibilities and rights of each owner.

Account Types and Joint Ownership Eligibility

This section details the various account types at Cit Bank that allow for joint ownership, outlining the eligibility requirements, restrictions, and legal considerations. Understanding these aspects is crucial for ensuring a smooth and compliant banking experience for all joint account holders.

Account Types Allowing Joint Ownership

The following table lists Cit Bank account types that support joint ownership. Please note that specific details, such as interest rates, may fluctuate and are subject to change. Always check the official Cit Bank website for the most current information.

| Account Type | Minimum Opening Deposit | Monthly Maintenance Fee | Interest Rate (if applicable) |

|---|---|---|---|

| Checking Account | $0 | $0 (may vary based on specific account features) | 0% |

| Savings Account | $100 | $0 (may vary based on specific account features) | Variable, based on market conditions |

| Money Market Account | $1000 | $0 (may vary based on specific account features) | Variable, based on market conditions |

| Joint CD (Certificate of Deposit) | Varies based on term and interest rate | $0 | Fixed, based on term and interest rate at opening |

Joint Owner Eligibility Requirements

Eligibility requirements for joint ownership vary slightly depending on the account type. However, certain basic requirements are consistent across all account types.

Checking Account:

- Age: Both joint owners must be at least 18 years old.

- Residency: Both joint owners must reside in a state where Cit Bank operates.

- Relationship: No specific relationship is required.

- Credit Score: Not applicable.

- Documentation: Government-issued photo ID and proof of address for both joint owners.

Savings Account, Money Market Account, and Joint CD:

- Age: Both joint owners must be at least 18 years old.

- Residency: Both joint owners must reside in a state where Cit Bank operates.

- Relationship: No specific relationship is required.

- Credit Score: Not applicable for Savings and Money Market Accounts. May be considered for certain high-yield CD options.

- Documentation: Government-issued photo ID and proof of address for both joint owners.

Restrictions and Limitations on Joint Ownership

Several restrictions and limitations apply to joint ownership at Cit Bank.

All Account Types:

- Number of Joint Owners: Generally, a maximum of two joint owners is allowed per account. Exceptions may exist for specific account types or circumstances.

- Adding/Removing a Joint Owner: Requires both existing joint owners’ signatures and the completion of a designated form. The new joint owner will also need to provide the necessary identification and documentation.

- Consequences of a Joint Owner’s Death: In most cases, survivorship rights apply, meaning the surviving joint owner automatically assumes full ownership of the account. However, specific probate procedures may apply depending on state laws and the account’s value.

- Liability: Both joint owners are equally liable for all transactions and debts incurred on the account.

- Access and Control: Typically, either joint owner can access and transact on the account independently unless specific restrictions are set up. This is subject to change based on the specific agreement between the joint owners and any stipulations made during account creation.

Comparison Table

| Account Type | Number of Joint Owners Allowed | Required Documentation | Access Control Restrictions | Survivorship Rights |

|---|---|---|---|---|

| Checking | Up to 2 | Government-issued ID and proof of address for each owner | Generally, independent access for each owner | Usually applies to the surviving owner |

| Savings | Up to 2 | Government-issued ID and proof of address for each owner | Generally, independent access for each owner | Usually applies to the surviving owner |

| Money Market | Up to 2 | Government-issued ID and proof of address for each owner | Generally, independent access for each owner | Usually applies to the surviving owner |

| Joint CD | Up to 2 | Government-issued ID and proof of address for each owner | Generally, independent access for each owner (unless otherwise specified) | Usually applies to the surviving owner |

Legal and Regulatory Compliance

Cit Bank’s joint ownership policies comply with relevant federal regulations, including the Uniform Commercial Code (UCC) and state laws governing joint tenancy and survivorship. Specific state regulations may vary.

Scenario-Based Examples

Scenario 1: Adding a joint owner to an existing account. The account holder completes a joint ownership application form, provides the necessary documentation for the new joint owner (ID and proof of address), and obtains the signature of both account holders.

Scenario 2: Removing a joint owner from an account. Both existing joint owners must complete a removal form and provide documentation. The removed joint owner will be notified.

Scenario 3: Handling the account after the death of a joint owner. The surviving joint owner will need to provide a death certificate and other necessary documentation to confirm their ownership and access the account.

Disclaimer

This information is for informational purposes only and does not constitute financial or legal advice. Please consult with a qualified professional for personalized guidance. Cit Bank’s policies are subject to change. Always refer to the official Cit Bank website for the most up-to-date information.

Responsibilities and Rights of Joint Owners

Opening a joint account at CIT Bank offers several advantages, but it’s crucial to understand the shared responsibilities and rights involved. Both parties share equal access and control, unlike a sole account where only one individual holds these privileges. This shared structure necessitates a clear understanding of the legal and financial implications.

Each joint owner shares equal responsibility for the account’s activity and its financial well-being. This includes monitoring transactions, ensuring sufficient funds are available, and adhering to the terms and conditions of the account agreement. Any action taken by one joint owner legally binds the other.

Shared Responsibilities of Joint Owners

Joint account holders share equal responsibility for all account activity. This means both individuals are liable for any overdrafts, fees, or debts incurred. They are equally responsible for managing the account’s finances and ensuring its responsible use. For instance, if one joint owner withdraws a significant amount of money, the other is equally responsible for the resulting balance. Similarly, both are liable for any unpaid fees or charges levied against the account. Effective communication and mutual agreement on financial decisions are crucial for successful joint account management.

Access and Control Rights of Joint Owners

Each joint owner typically enjoys unrestricted access to the account. This includes the ability to deposit and withdraw funds, write checks, use debit cards, and access online banking features. There are no limitations imposed on one joint owner’s access based on their individual contribution to the account balance. Both individuals have equal authority to make changes to the account, such as adding or removing beneficiaries. This shared control offers convenience but necessitates open communication and mutual trust.

Legal Implications of Joint Ownership versus Sole Ownership

Joint ownership differs significantly from sole ownership in terms of legal liability and access. In a sole account, only the account holder is responsible for the account’s activity. With joint ownership, both individuals are equally liable for all transactions, regardless of who initiated them. Upon the death of one joint owner, the surviving owner automatically assumes full ownership of the account, avoiding the probate process often associated with sole accounts. This automatic transfer of ownership is a key difference and a significant benefit of joint ownership. Conversely, in a sole account, the account’s disposition after death is governed by the deceased’s will or intestacy laws. Understanding these legal implications is critical before choosing between joint and sole ownership.

The Process of Removing a Joint Owner

Removing a joint owner from a Cit Bank account is a significant decision requiring careful consideration. This process involves several steps and may have legal and financial implications for all parties involved. It’s crucial to understand these implications before proceeding. This section Artikels the procedure and potential consequences.

The process of removing a joint owner from a Cit Bank account typically involves contacting Cit Bank directly. This can be done through various channels, including visiting a branch, calling their customer service line, or using their online banking platform. You will need to provide identification and account information to verify your ownership and initiate the removal process. The specific steps may vary slightly depending on the account type and the circumstances. Cit Bank’s representatives will guide you through the necessary paperwork and procedures.

Required Documentation and Verification

To successfully remove a joint owner, you will need to provide Cit Bank with specific documentation to verify your identity and your authority to make this change. This typically includes government-issued identification, such as a driver’s license or passport, and possibly the original account agreement. Additional documentation may be required depending on the account type and the circumstances surrounding the removal. Cit Bank’s representatives will advise you on the necessary documents during the process. Failure to provide the required documentation will delay or prevent the removal of the joint owner.

Step-by-Step Guide to Removing a Joint Owner

While the exact steps may vary depending on the chosen communication method (phone, online, in-person), the core process remains consistent. The following Artikels a general approach:

- Contact Cit Bank customer service through your preferred method (phone, online chat, or in-person visit).

- Clearly state your intention to remove a joint owner from your account, providing the account number and the name of the joint owner to be removed.

- Provide the necessary identification and documentation as requested by the representative.

- The representative will guide you through the necessary forms and procedures.

- Once the process is complete, you will receive confirmation of the change.

Potential Consequences of Removing a Joint Owner

Removing a joint owner can have significant consequences. The removed individual will no longer have access to the account or the funds within it. This could impact their ability to pay bills or access funds for emergencies, if they relied on the account. Furthermore, depending on the account’s history and the agreement between the joint owners, there might be legal ramifications. It is advisable to have a clear understanding of the account’s status and any potential disputes before initiating the removal process. In some cases, legal counsel may be recommended.

Security and Fraud Prevention Related to Joint Ownership

Protecting your finances is paramount, especially when managing a joint account. Cit Bank employs a multi-layered approach to security, ensuring the safety and integrity of your shared funds. This section details the robust measures in place to safeguard your joint account from unauthorized access and fraudulent activity.

Security Measures for Cit Bank Joint Accounts

Cit Bank utilizes advanced technological and physical security measures to protect joint accounts. These measures are designed to prevent unauthorized access and detect fraudulent activity, providing peace of mind for all account holders.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second form of verification, such as a one-time code sent to your registered mobile phone or email, in addition to your password, for all login attempts. This applies to online banking, mobile app access, and even some ATM transactions, significantly reducing the risk of unauthorized access even if your password is compromised. For joint accounts, each owner will need to set up their own 2FA.

- Data Encryption: All data transmitted between your device and Cit Bank’s servers is encrypted using industry-standard encryption protocols (e.g., TLS/SSL), protecting your sensitive information from interception during transmission. This ensures that even if data is intercepted, it remains unreadable without the decryption key.

- Fraud Detection Systems: Sophisticated algorithms constantly monitor account activity for unusual patterns indicative of fraudulent behavior. These systems analyze transaction amounts, locations, times, and other data points to identify potential fraud attempts in real-time. Alerts are triggered for suspicious activities, allowing for prompt investigation and intervention. This monitoring applies equally to all account types, including joint accounts.

- Online, Mobile, and ATM Security: Cit Bank employs robust security protocols for all access points. This includes secure login procedures, regular software updates to patch vulnerabilities, and monitoring for suspicious login attempts. ATM transactions are protected by encryption and fraud detection systems.

Cit Bank also maintains rigorous physical security measures at its data centers. These include 24/7 surveillance, restricted access control, and advanced fire suppression systems. Employee background checks and strict access control policies further protect account information from internal threats. All employee access to joint account data is logged and monitored for any unusual activity.

Reporting Fraud or Unauthorized Access in a Joint Account

If you suspect fraudulent activity or unauthorized access to your joint account, prompt reporting is crucial.

- Contact Cit Bank Immediately: Call our dedicated fraud hotline at 1-800-555-1212 (example number – replace with actual number) or contact us through our secure online portal at [example link – replace with actual link]. You can also email us at [email protected] (example email – replace with actual email).

- Provide Necessary Documentation: Gather all relevant documentation, including copies of your recent account statements showing the fraudulent transactions, your identification documents (driver’s license, passport), and any other supporting evidence.

- Temporary Account Freeze (Authority): Either joint account holder can request a temporary freeze on the account pending investigation. This prevents further unauthorized transactions.

Cit Bank aims to respond to fraud reports within 24-48 hours. A dedicated fraud investigation team will review the evidence and take appropriate action.

Liability in Case of Fraudulent Activity on a Joint Account

Liability for fraudulent activity on a joint account depends on the circumstances and the type of joint ownership.

- One Account Holder Responsible: If one account holder is proven to be directly responsible for the fraudulent activity (e.g., knowingly providing account information to a third party), that individual will bear the primary liability. The other joint account holder may not be held liable unless they were complicit or negligent.

- Both Account Holders Equally Liable: If neither account holder is directly responsible, but the fraud occurred due to negligence (e.g., failure to report suspicious activity or protect account credentials), both may share liability. This is especially true if both account holders had equal access and control over the account.

Victims of fraud can pursue legal recourse, including filing a police report and potentially suing the responsible party or seeking compensation through their credit card company or insurance provider if applicable. Cit Bank’s internal fraud policies ensure thorough investigation and appropriate disciplinary action against any employee found to have committed fraud.

| Joint Ownership Type | Liability in Case of Fraud (by one holder) | Liability in Case of Fraud (by both holders) |

|---|---|---|

| Joint Tenants with Right of Survivorship | The fraudulent holder is solely liable; the surviving holder inherits the remaining funds unaffected by the fraud. | Both are equally liable unless proven otherwise. |

| Tenants in Common | The fraudulent holder is solely liable for their share; the other holder’s share remains unaffected. | Both are equally liable for their respective shares unless proven otherwise. |

Additional Security Considerations

Sharing account access information with third parties, even family members, increases the risk of fraud and complicates liability. Cit Bank strongly recommends against sharing your account login credentials or sensitive information. If you need to share access for legitimate reasons, consider using a limited-access account or a power of attorney with clear defined permissions. Regularly review your account statements for any unauthorized transactions.

Tax Implications of Joint Ownership

Understanding the tax implications of a joint bank account is crucial for responsible financial management. The tax treatment of funds held in a joint account differs from a sole account, primarily concerning income generated within the account and the reporting of that income to tax authorities. This section will clarify these differences and Artikel the relevant tax reporting requirements.

Joint ownership of a bank account generally means that both account holders are equally responsible for any taxes levied on the interest or other income generated by the account. This differs significantly from sole ownership, where the individual account holder is solely responsible for reporting and paying taxes on any income. The Internal Revenue Service (IRS) in the United States, for example, typically treats interest earned in a jointly owned account as equally distributed between the account holders, regardless of who deposited the initial funds.

Tax Reporting Requirements for Joint Accounts

The tax reporting requirements for joint accounts vary depending on the type of income generated and the jurisdiction. In many countries, including the United States, interest earned in a joint account is reported on each owner’s individual tax return. The interest is typically reported on Form 1099-INT, which the bank provides to each account holder. Each owner reports their share of the interest income, reflecting their equal ownership. For example, if a joint account earns $1,000 in interest, each owner would report $500 on their respective tax returns. This applies regardless of who made the deposits or primarily used the funds. Dividends and other investment income from accounts held jointly are subject to similar reporting requirements, following the principle of equal distribution for tax purposes. It is crucial to consult with a tax professional to ensure accurate and compliant reporting, particularly in complex scenarios involving multiple income sources or varying ownership percentages.

Comparison of Tax Implications: Joint vs. Sole Ownership

The primary difference between the tax implications of joint and sole ownership lies in the responsibility for reporting and paying taxes on income generated within the account. In a sole ownership account, the individual account holder is solely responsible for reporting and paying taxes on all income earned. In a joint account, the responsibility is shared equally among the owners, irrespective of the individual contributions to the account balance. For instance, if a sole proprietor earns $2,000 in interest in their individual account, they are solely responsible for reporting and paying taxes on the entire amount. However, if the same interest is earned in a joint account, each owner reports and pays taxes on half of the amount ($1,000 each). This shared responsibility is a key distinction and has implications for tax liability and the overall tax burden on each individual. Furthermore, the tax bracket of each individual owner will affect their overall tax liability on their respective shares of the joint account income.

Common Issues and Troubleshooting

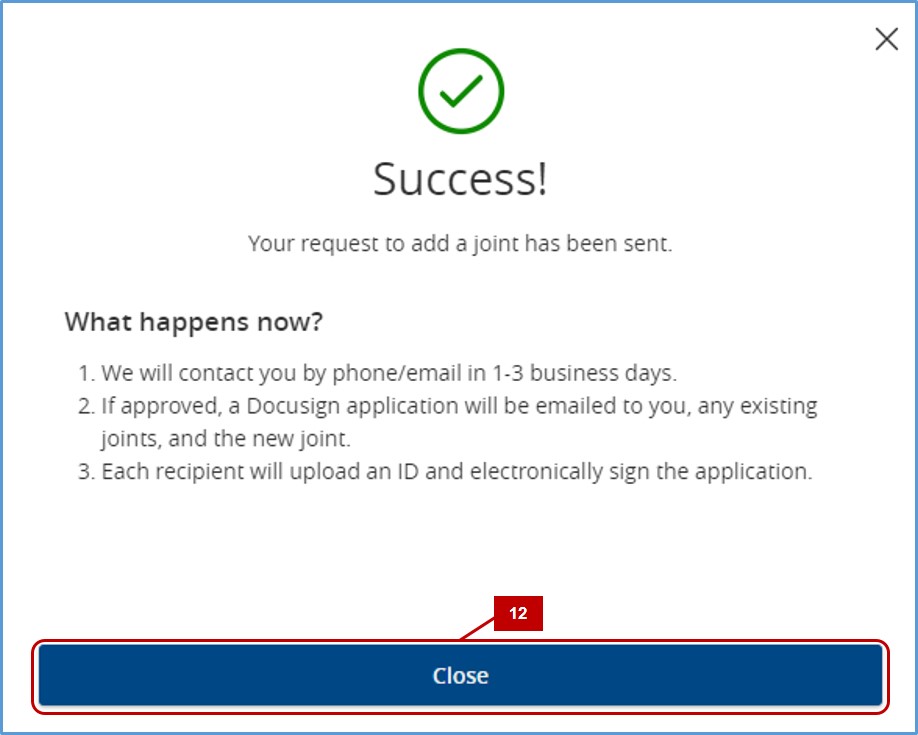

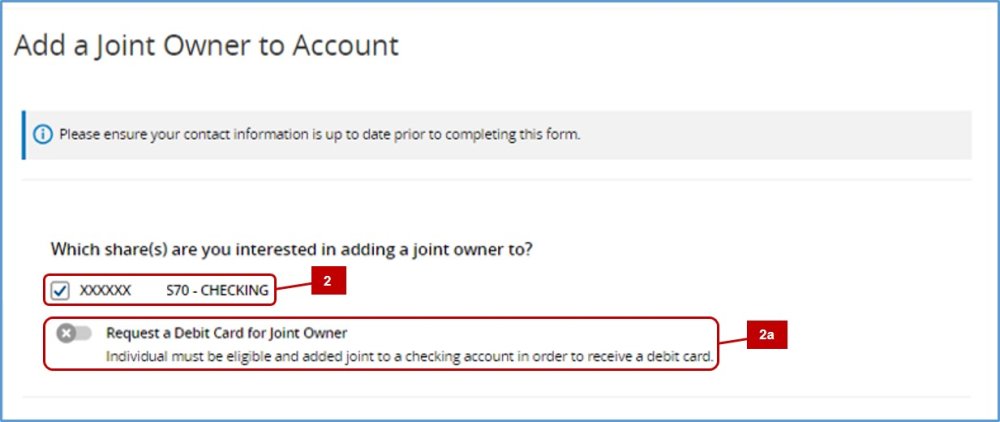

Adding a joint owner to your Cit Bank account is generally a straightforward process, but occasional difficulties can arise. Understanding potential problems and their solutions can help ensure a smooth experience. This section Artikels common issues and provides practical troubleshooting steps.

Account Access Issues After Adding a Joint Owner

After adding a joint owner, both account holders may experience difficulties accessing the account online or via mobile app. This might involve incorrect login credentials, forgotten passwords, or temporary account lockouts due to multiple failed login attempts. These issues are usually unrelated to the addition of the joint owner itself, but rather stem from standard security protocols.

Incorrect or Missing Information During the Joint Owner Addition Process, Cit bank add joint owner

Providing inaccurate or incomplete information during the joint owner addition process can lead to delays or rejection of the application. This might include errors in the joint owner’s name, address, Social Security number, or date of birth. Double-checking all information before submission is crucial. If errors are detected after submission, contacting Cit Bank customer support for correction is necessary.

Technical Glitches During Online Application

Occasionally, technical difficulties on Cit Bank’s website or app may hinder the joint owner addition process. These glitches can manifest as website errors, slow loading times, or unexpected application crashes. If encountered, trying again later, using a different browser or device, or contacting Cit Bank customer support for assistance is recommended. Checking for planned maintenance announcements on the Cit Bank website before starting the process can also be helpful.

Understanding Joint Account Responsibilities

Misunderstandings about the responsibilities and rights of joint account holders can lead to conflicts. Each joint owner has equal access and control over the account, unless otherwise specified in a legal agreement. Clear communication between joint owners regarding account activity and financial decisions is vital to avoid disputes. For example, both owners should be aware of and agree on the limits for withdrawals or online transactions.

Verification and Identification Challenges

Cit Bank may require additional verification steps to confirm the identity of the joint owner. This might involve providing additional documentation, such as a copy of a government-issued ID or proof of address. Failure to provide the necessary documentation promptly may delay the process. Promptly responding to any verification requests from Cit Bank is crucial.

Delayed Processing Times

While the addition of a joint owner is typically a quick process, unforeseen delays can occur. These delays might be due to high application volumes, internal processing issues, or the need for additional verification. Checking the application status online or contacting Cit Bank customer support for updates is advisable if a delay occurs. Cit Bank generally provides estimated processing times on their website.

Online vs. In-Person Procedures for Adding a Joint Owner

Adding a joint owner to a financial account offers several benefits, including shared access and simplified management. However, the process can vary significantly depending on whether it’s done online or in person. This section compares and contrasts these methods for adding a joint owner to a checking account, using Citibank and Bank of America as representative examples.

Comparative Analysis

Adding a joint owner to a checking account online generally offers convenience and speed, often requiring only a few clicks and the verification of existing account credentials. In contrast, the in-person method necessitates a visit to a branch, potentially involving longer wait times and the need to present physical documentation. While online methods prioritize speed and accessibility, in-person methods might offer more personalized assistance and immediate resolution of any potential issues. The choice depends on individual preferences and circumstances.

Advantages and Disadvantages

| Method | Advantage | Disadvantage | Note |

|---|---|---|---|

| Online (Citibank/BOA) | Convenience, speed, 24/7 accessibility | Requires strong internet connection and digital literacy; potential security risks | May require digital signatures and verification steps |

| In-Person (Citibank/BOA) | Personalized assistance, immediate resolution of issues, secure handling of documents | Requires travel to a branch, potential wait times, limited availability (branch hours) | May involve more paperwork |

Online Process: Adding a Joint Owner to a Citibank Checking Account

| Step Number | Step Description | Required Information/Action | Potential Issues/Troubleshooting |

|---|---|---|---|

| 1 | Log in to Online Banking | Citibank username and password | Forgotten password? Use password reset feature. |

| 2 | Navigate to Account Management | Follow on-screen prompts to locate the “Account Management” or similar section. | Unable to locate? Contact Citibank customer support. |

| 3 | Select “Add Joint Owner” | Choose the specific checking account and select the “Add Joint Owner” option. | Option unavailable? Check account eligibility requirements. |

| 4 | Enter Joint Owner Information | Provide the joint owner’s full name, address, date of birth, and Social Security Number (SSN). | Incorrect information? Double-check details for accuracy. |

| 5 | Verify Identity | Complete the identity verification process as required by Citibank’s security protocols. | Verification issues? Contact Citibank customer support. |

| 6 | Review and Submit | Carefully review all entered information and submit the request. | Unable to submit? Check for errors in the provided information. |

In-Person Process: Adding a Joint Owner to a Bank of America Checking Account

| Step Number | Step Description | Required Information/Action | Potential Issues/Troubleshooting |

|---|---|---|---|

| 1 | Visit a Bank of America Branch | Locate the nearest Bank of America branch and visit during opening hours. | Branch closed? Check Bank of America’s website for branch locations and hours. |

| 2 | Request to Add a Joint Owner | Inform a bank representative of your intention to add a joint owner to your checking account. | Representative unavailable? Wait for the next available representative. |

| 3 | Provide Documentation | Present valid government-issued photo IDs (yours and the joint owner’s) and proof of address. | Missing documents? Obtain the necessary documents before visiting the branch. |

| 4 | Complete the Application | Complete the necessary paperwork provided by the bank representative. | Questions about the application? Ask the bank representative for clarification. |

| 5 | Review and Sign | Review all information and sign the application. | Discrepancies? Verify the accuracy of the information with the representative. |

Documentation Required

| Method | Required Documentation |

|---|---|

| Online (Citibank/BOA) | Account credentials, joint owner’s personal information (name, address, DOB, SSN) |

| In-Person (Citibank/BOA) | Government-issued photo IDs (yours and the joint owner’s), proof of address, potentially additional documentation as required by the bank. |

Fees

Generally, there are no fees associated with adding a joint owner to a checking account, either online or in-person, at major institutions like Citibank and Bank of America. However, it is always advisable to confirm this directly with the institution.

Turnaround Time

Online methods typically process requests within a few business days. In-person methods may be completed instantly, depending on branch availability and processing times.

Security Considerations

Security Considerations: Online methods may be susceptible to phishing scams. Verify the website’s legitimacy before entering sensitive information. In-person methods may carry a risk of identity theft if documents are not properly secured. Always shred any sensitive documents after use.

Accessibility Considerations

Online methods generally offer better accessibility for users with disabilities through screen readers and keyboard navigation. However, in-person accessibility depends on the specific branch’s facilities and staff training. Many banks provide accommodations for customers with disabilities upon request.

Legal Considerations for Joint Ownership Agreements: Cit Bank Add Joint Owner

Establishing a joint ownership agreement for a CIT Bank account carries significant legal implications. Understanding these implications is crucial to ensuring a smooth and legally sound arrangement for all parties involved. This section will Artikel the key legal aspects of joint ownership, focusing on the rights and responsibilities of each owner, and providing a sample agreement.

Rights and Responsibilities of Joint Account Holders

Joint account holders share both rights and responsibilities regarding the account. Each joint owner typically has the right to deposit and withdraw funds, write checks, and access account information. However, responsibilities extend to maintaining the account’s financial health and adhering to the bank’s terms and conditions. For example, all joint owners are equally liable for any overdrafts or outstanding debts associated with the account. Disputes between joint owners regarding account management must be resolved amicably or through legal channels, depending on the agreement in place. The specific rights and responsibilities can be further defined within a comprehensive joint ownership agreement.

Sample Joint Ownership Agreement

A well-defined joint ownership agreement protects all parties involved and minimizes potential disputes. This sample agreement should be adapted to reflect the specific circumstances of the account holders. Legal counsel is recommended to ensure the agreement is legally sound and complies with all applicable laws.

This Joint Ownership Agreement, effective [Date], is made between [Name of Joint Owner 1], residing at [Address], and [Name of Joint Owner 2], residing at [Address], hereinafter referred to as “Joint Owners,” regarding a joint account held at CIT Bank with account number [Account Number].

1. Right of Access: Both Joint Owners have equal rights to access and manage the account, including depositing, withdrawing, and transferring funds.

2. Liability: Both Joint Owners are jointly and severally liable for all transactions and debts incurred on the account.

3. Decision-Making: Decisions regarding the account will be made jointly by both Joint Owners. In the event of a disagreement, the parties agree to attempt to resolve the matter amicably. If an amicable resolution cannot be reached, the matter will be submitted to [Dispute Resolution Method, e.g., arbitration].

4. Account Closure: The account may be closed by either Joint Owner, provided that the other Joint Owner is given [Number] days’ written notice.

5. Death of a Joint Owner: Upon the death of one Joint Owner, the surviving Joint Owner will automatically become the sole owner of the account. [Specify if there are any alternative arrangements].

6. Governing Law: This agreement shall be governed by and construed in accordance with the laws of [State/Jurisdiction].

IN WITNESS WHEREOF, the parties have executed this agreement as of the date first written above.

_________________________ _________________________

[Signature of Joint Owner 1] [Signature of Joint Owner 2]_________________________ _________________________

[Printed Name of Joint Owner 1] [Printed Name of Joint Owner 2]

Consequences of Breach of Agreement

A breach of the joint ownership agreement, such as unauthorized withdrawals or failure to adhere to agreed-upon decision-making processes, can lead to legal disputes. These disputes can involve costly litigation and potentially damage the relationship between the joint owners. Therefore, a clearly defined and legally sound agreement is crucial to avoid future conflicts.

Customer Service Contact Information and Support

We understand that managing your finances can sometimes require assistance, and Cit Bank is committed to providing you with exceptional customer support. We offer a variety of convenient ways to reach us, ensuring you can get the help you need when you need it. The following table Artikels our contact methods and typical response times. Please note that response times may vary depending on the time of day and volume of calls or inquiries.

Contact Methods and Response Times

Below is a table summarizing the various ways to contact Cit Bank customer service, along with estimated response times. These are averages and may vary depending on several factors.

| Contact Method | Phone Number | Email Address | Average Response Time |

|---|---|---|---|

| Phone | 1-800-CIT-BANK (1-800-248-2265) | N/A | Typically answered within 5-10 minutes during peak hours; shorter wait times during off-peak hours. |

| N/A | [email protected] (Example – replace with actual Cit Bank email address) | Emails are typically responded to within 24-48 business hours. | |

| Online Chat | N/A | N/A (Available through the Cit Bank website or mobile app) | Live chat support is generally available during business hours and usually provides immediate assistance. |

| N/A | [Cit Bank Mailing Address] (Example – replace with actual Cit Bank mailing address) | Mail response times can vary greatly depending on postal service, but generally take 5-7 business days or longer. |

For the most efficient service, we recommend utilizing our online chat feature during business hours or calling our customer service line. For non-urgent matters, email support is a convenient option.

Account Access and Control Features for Joint Accounts

At CIT Bank, we understand that joint accounts require robust access and control features to ensure both security and ease of management for all account holders. Our system offers a range of features designed to meet the diverse needs of our joint account customers, providing flexibility and control while maintaining the highest security standards. This section details these features, their benefits, and the processes involved in their management.

Detailed Feature Description

CIT Bank offers several access and control features tailored for joint accounts. The primary account holder has full access to all account functions, while secondary account holders can have their access customized. There are no tiered access levels beyond primary and secondary designations; however, access can be restricted by the primary account holder. Adding a joint account holder requires the primary account holder’s authorization and submission of the secondary account holder’s identification documents. Removing a joint account holder also requires the primary account holder’s authorization and completion of a removal form. This process ensures that only authorized individuals have access to the account. Our fraud prevention mechanisms include transaction alerts, real-time monitoring, and two-factor authentication, which enhance the security of each transaction. Disputes between joint account holders are handled through our customer service department, which will investigate and mediate based on account agreements and documented transactions. Changing account access levels involves a simple online request by the primary account holder, subject to verification. Limitations might apply based on regulatory requirements. In the event of the death of one account holder, the surviving joint owner automatically assumes full ownership. The bank will require a copy of the death certificate to update the account records.

Security and Management Enhancement Analysis

The following table compares the security and management benefits of key features with their potential risks and mitigation strategies.

| Feature Name | Security Enhancement | Management Enhancement | Potential Risks | Mitigation Strategies |

|---|---|---|---|---|

| Transaction Alerts | Real-time notification of suspicious activity | Improved monitoring of account activity | Potential for alert fatigue | Customizable alert thresholds and preferences |

| Two-Factor Authentication | Adds an extra layer of security beyond passwords | Simplified access management | Potential for inconvenience | Multiple authentication methods available |

| Account Freeze/Unfreeze | Prevents unauthorized access in case of loss or theft | Provides control over account accessibility | Potential for temporary disruption of access | Clear instructions and quick unfreeze process |

| Individual Transaction Authorization | Ensures only authorized transactions are processed | Enhanced control over spending | Potential for delays in transaction processing | Streamlined authorization process |

Account recovery involves contacting CIT Bank’s customer service department. For forgotten passwords, both primary and secondary account holders will undergo a verification process to regain access. If access is lost due to other reasons, supporting documentation may be required.

Feature Illustration and Benefits

The following features enhance security and management of joint accounts:

- Transaction Limits: Allows the primary account holder to set spending limits for secondary account holders, reducing the risk of unauthorized large transactions. Benefit: Reduces potential losses from unauthorized spending.

- Notification Preferences: Customizable alerts for various account activities, such as low balances, large withdrawals, and suspicious login attempts. Benefit: Enables proactive monitoring and faster response to potential fraud.

- Account Alerts: Real-time notifications of significant account changes, providing immediate awareness of potential issues. Benefit: Early detection of fraudulent activity.

- Individual Transaction Authorization: Requires the primary account holder’s approval for specific transactions exceeding a predefined threshold. Benefit: Provides enhanced control and reduces the risk of unauthorized spending.

- Joint Transaction Approval Requirements: Requires both joint account holders to approve certain transactions. Benefit: Enhanced security against unauthorized activity by either account holder.

- Freeze/Unfreeze Account Functionality: Allows either account holder to temporarily freeze the account in case of suspected compromise. Benefit: Immediate security measure to prevent unauthorized access.

- Access Control through a Mobile App: Provides convenient and secure account management via a mobile device. Benefit: Enhanced convenience and accessibility.

- Two-Factor Authentication Options: Multiple methods (SMS, authentication app) for secure account access. Benefit: Significantly reduces the risk of unauthorized access.

Legal and Compliance Considerations

CIT Bank’s joint account features comply with all relevant banking regulations and data privacy laws, including GDPR and CCPA. We maintain strict data security protocols and adhere to all financial reporting requirements. All account activities are logged and auditable, ensuring transparency and accountability.

User Scenarios

- Scenario 1: One account holder travels abroad and temporarily restricts the other’s access to online banking. The primary account holder can easily adjust access permissions through online banking or the mobile app.

- Scenario 2: One account holder becomes incapacitated. The other account holder can access and manage the account with appropriate documentation proving their authority.

- Scenario 3: A dispute arises regarding a specific transaction. CIT Bank’s customer service will investigate the transaction based on available documentation and account history, mediating the dispute fairly.

Summary

CIT Bank’s joint account access and control features prioritize security, ease of management, and a positive user experience. The combination of customizable access levels, robust fraud prevention mechanisms, and clear account recovery processes ensures that joint account holders have the tools they need to manage their finances securely and efficiently. Features like transaction alerts, two-factor authentication, and account freeze functionality significantly mitigate the risks associated with shared accounts. The intuitive design of these features, accessible via online banking and mobile app, further enhances user convenience and control. Our commitment to compliance with relevant regulations ensures a secure and legally sound environment for all joint account holders.

Changes to Joint Ownership After Account Opening

Modifying the joint ownership arrangement on your CIT Bank account after its initial setup is a straightforward process, though it’s crucial to understand the implications before proceeding. This section details the steps, required documentation, and potential consequences of such changes. Remember to always consult with a financial advisor or legal professional for personalized advice.

Types of Joint Ownership and Change Procedures

CIT Bank offers various joint ownership types, each with its own process for modification. The most common types are Joint Tenants with Right of Survivorship (JTWROS) and Tenants in Common (TIC). JTWROS means ownership passes automatically to the surviving owner(s) upon the death of one owner, while TIC allows for individual ownership shares that can be bequeathed in a will. The process for changing the ownership structure differs depending on the initial type and the desired modification. Online changes are typically facilitated through the bank’s secure website, while in-person changes require visiting a branch.

Steps and Required Documentation for Joint Ownership Changes

The following table Artikels the steps and required documentation for various joint ownership changes. Note that specific requirements might vary slightly depending on the type of account and the nature of the change.

| Step | Action | Required Documentation | Notes |

|---|---|---|---|

| 1 | Complete Change of Ownership Form | Government-issued ID for all parties involved, Account Number | Ensure all signatures are witnessed by a notary public. |

| 2 | Submit form and documentation to the bank | Proof of address for all parties, existing account details | Allow 5-7 business days for processing. Online submissions may be faster. |

| 3 | Receive confirmation of ownership change | Updated account statement reflecting the change | Contact customer service if confirmation is delayed beyond the expected timeframe. |

Implications of Joint Ownership Changes

Altering a joint ownership arrangement has several implications, including tax, legal, and beneficiary considerations. For instance, removing a joint owner from a JTWROS account means the remaining owner(s) assume sole ownership, potentially triggering tax implications depending on the account balance and jurisdiction. Similarly, changing from JTWROS to TIC alters how the account is distributed upon death, requiring the deceased’s will to dictate the distribution of their share. Beneficiaries designated on the account may also be affected by these changes.

Specific Scenarios and Solutions

Let’s examine specific scenarios and their solutions:

- Changing from JTWROS to TIC: This requires completing the Change of Ownership form specifying the desired change and the percentage ownership for each party. All parties must sign and provide the required documentation.

- Adding a new joint owner: The existing owners complete the Change of Ownership form, including the new owner’s information and documentation. All parties must agree to the addition.

- Removing a joint owner due to death or incapacitation: A death certificate or legal documentation proving incapacitation is required, along with the Change of Ownership form completed by the remaining owner(s).

- Correcting an error in the joint ownership information: Submit a Change of Ownership form with supporting documentation correcting the error. This might involve updated IDs or proof of address.

Fees Associated with Joint Ownership Changes

CIT Bank may charge a fee for processing changes to joint ownership. The specific fee amount may vary depending on the type of change and may be waived under certain circumstances. It is best to contact CIT Bank directly for the most up-to-date information on fees.

Illustrative Scenario: Adding a Joint Owner to a Citibank Checking Account

This scenario details the process of adding a joint owner to a Citibank checking account, highlighting both online and in-person methods. We’ll cover required documentation, potential challenges, and the resulting account activity and responsibilities.

Adding a Joint Owner: A Step-by-Step Guide

This section provides a detailed walkthrough of adding a joint owner to a Citibank Basic Checking account, using both online and in-person methods.

Existing Account Holder: Jane Doe, Account Number: 1234567890, Citibank customer for 10 years.

New Joint Owner: John Smith, Address: 123 Main Street, Anytown, CA 91234, Date of Birth: 01/01/1980, Relationship to Jane Doe: Husband.

Required Documents

Before initiating the process, gather the necessary documentation for both the existing and new account holder. This typically includes government-issued photo identification (driver’s license, passport), proof of address (utility bill, bank statement), and possibly a completed joint ownership application form.

Online Process

1. Log in to your Citibank online banking account using your username and password.

2. Navigate to the “Accounts” section and select your checking account.

3. Locate and click the “Add Joint Owner” option.

4. Enter the new joint owner’s information (full name, address, date of birth, Social Security Number). The system might request you to verify this information using a security question or one-time code.

5. Upload clear scans of the required identification and address verification documents. Ensure these are high-quality images to avoid processing errors.

6. Review all entered information and submit the request. You might receive a confirmation number or email once the request is successfully submitted.

7. Potential error messages: “Invalid Social Security Number,” “Document upload failed,” “Insufficient verification.” Solutions typically involve double-checking the entered information and ensuring that uploaded documents are clear and legible.

In-Person Process

1. Visit your nearest Citibank branch. Be prepared for potential wait times, which can vary depending on the time of day and branch location.

2. Request a “Joint Ownership Application” form from a bank representative.

3. Complete the form accurately, providing all the required information for both account holders.

4. Submit the completed form along with original copies of the required identification and address verification documents. A bank representative will review the documents and process the application.

5. You will receive a confirmation once the process is complete.

Comparison of Online and In-Person Methods

| Method | Speed | Required Documentation | Potential Challenges |

|---|---|---|---|

| Online | Faster (usually within 1-3 business days) | Digital copies of ID and proof of address | Technical issues, document upload errors |

| In-Person | Slower (may take several business days) | Original copies of ID and proof of address | Wait times, potential errors in manual data entry |

Account Activity After Adding a Joint Owner

After adding John Smith as a joint owner, both Jane and John can access the account online and in person. They can initiate transactions independently (deposits, withdrawals, bill payments). Transaction ID examples: Deposit – TXN12345, Withdrawal – TXN67890. Account statements are typically sent to both owners. Either owner can access the statement online without the other’s involvement. Both Jane and John share equal liability and responsibility for all account activity.

Removing a Joint Owner

To remove a joint owner, both Jane and John must visit a Citibank branch with their IDs. They must complete a joint owner removal form and present any other requested documents.

Adding a joint owner to a checking account creates a joint tenancy with rights of survivorship, meaning each owner has equal access and control, and the surviving owner automatically inherits the account upon the death of the other. This carries significant legal and financial responsibilities. (Hypothetical Citation: Uniform Commercial Code § 3-110)

Jane Doe’s Experience

Adding John as a joint owner to my Citibank account was surprisingly straightforward. The online process was quick and efficient, taking less than 15 minutes. The only minor challenge was ensuring the uploaded documents met the required resolution. Having John’s name on the account gives me peace of mind, knowing he can access the funds if needed. The joint ownership simplifies bill payments and managing our finances.

Frequently Asked Questions

- Q: Can I add a joint owner to my account without their presence? A: No, both parties must be involved in the process, either online or in person.

- Q: What happens to the account if one joint owner dies? A: The surviving joint owner automatically inherits the account.

- Q: Can I add a minor as a joint owner? A: This is generally not allowed; Citibank may require a custodial account instead.

- Q: What if I have a dispute with the joint owner regarding account activity? A: Contact Citibank customer service to discuss the matter and potential resolution options.

- Q: Can I change the joint owner’s rights or responsibilities after adding them? A: You will need to contact Citibank to discuss the process of altering the joint ownership agreement.

Adding a joint owner to your Cit Bank account offers significant benefits, but careful planning and understanding of the process are essential. This guide has provided a detailed overview of the steps involved, the different account types, and the legal and security implications. By understanding your responsibilities and rights, and utilizing Cit Bank’s security features, you can ensure a seamless and secure financial partnership. Remember to always refer to Cit Bank’s official website for the most up-to-date information and consult with a financial advisor for personalized guidance.

Quick FAQs

What happens if one joint owner dies?

This depends on the type of joint ownership selected (e.g., joint tenants with right of survivorship, tenants in common). Cit Bank’s policies will Artikel the procedure, often involving survivorship rights.

Can I add a joint owner to a savings account?

Yes, provided the account type allows joint ownership and the eligibility requirements are met for both account holders. Check Cit Bank’s website for specific account details.

What if I disagree with a joint owner on a transaction?

Clear communication is key. If a disagreement arises, review the account agreement to understand transaction authorization rules. If necessary, contact Cit Bank’s customer service for assistance.

Are there any fees associated with adding a joint owner?

Cit Bank’s fee structure may vary depending on the account type. Check your account agreement or contact customer service for details.